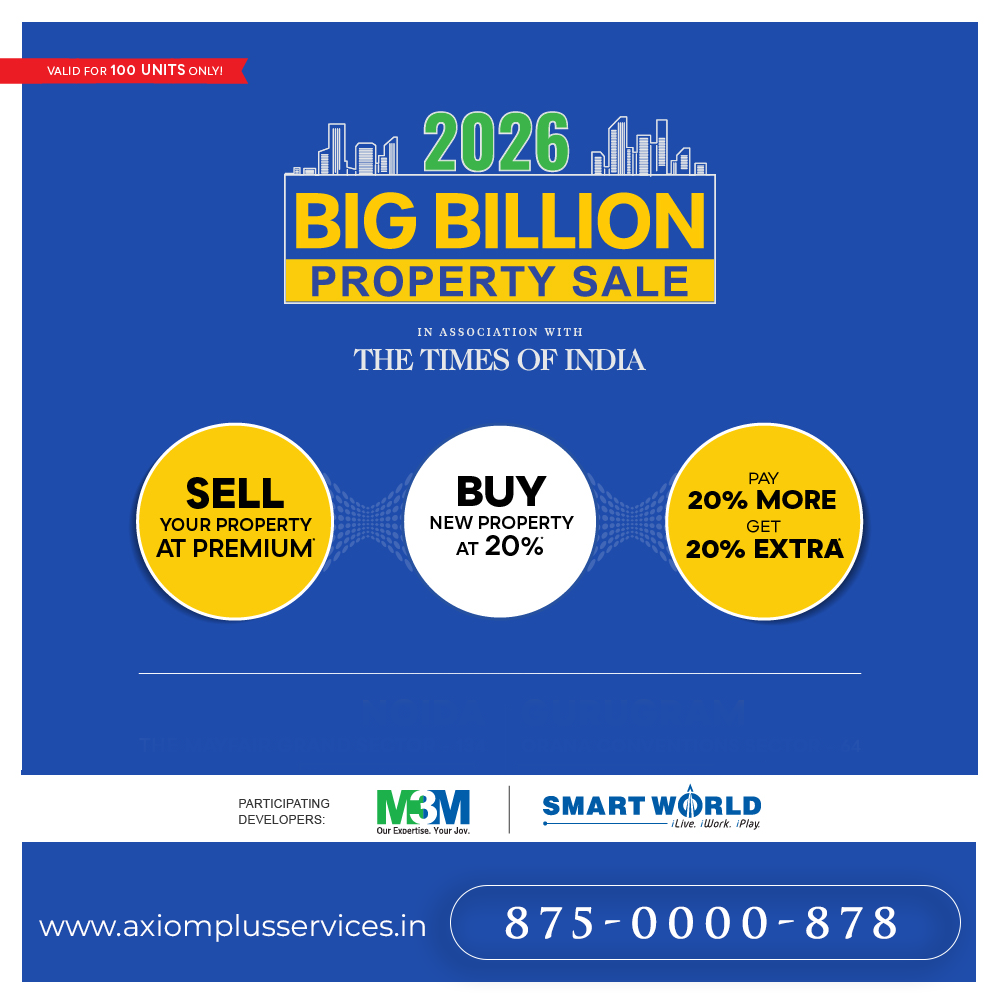

The M3M Smartworld Big Billion Property Sale 2026 is a big deal when it comes to real estate and brings together high quality homes and transparent financial terms. It is one of the largest inventory boosting event of North India. It has a verified portfolio of more than 75 projects in Gurgaon, Noida and Panipat which is worth Rs.25,000 Crore. The sale is not a promotion of seasonal discount. Instead, it is a liquidity driven platform that enables smoothness in the flow of capital, realignment of portfolios and maximisation of transaction efficiency before government budget year ends.

The strategy distinguishes the sale from normal fairs. The event is divided into regional windows and is aimed at focusing buyers in each market. By supporting Noida and Gurgaon separately, the sale helps by reducing the overlaps and bringing a concentration of buyers. This format helps to deepen evaluation and facilitates faster decision making. The planning is controlled and precise, allowing for the scale.

The model of sale shifts from a discounted one to structured finance. In the new “Buy From Us, Sell To Us” proposition, Assure 2.0 plays a key role. Liquidity constraints typically slow down investment. Exit uncertainty is eliminated by this sale. Existing owners may bring selling inventory at guaranteed prices and use cash to purchase a newer one in the same ecosystem. It reduces brokerage losses, minimizes holding risk and makes property rebalancing a smooth financial process.

The mechanics of the sale indicate the possibility of exit security and capital growth can be achieved together. You can sell properties bought earlier, at assured prices, and free up capital for some premium builds. Zero brokerage and transfer fees increase the efficiency and reduce the friction. The path makes exit security a primary investment characteristic, rather than a parenthesis.

Smart payment options provide added value. Buyers receive reduced initial exposure with a smaller upfront booking fee and subsequent installments. There are no EMIs and waivers to maintenance extend once possession is made. These features provide buyers with liquidity comfort and stable cash flow. Participation tends to coincide with good capital management as opposed to speculation.

In Gurgaon International City, sale provides a platform for entry in early stages for investors. Projects are available with little initial commitment and delayed obligations, which makes it easy for buyers to get in during growth stages of the project. By joining structured finance with location-driven appreciation, Gurgaon International City is a high efficiency gateway to premium developments.

The commercial part is based on a performance-backed model. A 12% rental return framework provides definite income for yield-focused investors. Deferred payment schedules coincide with the beginning of rent, which provides a natural buffer of cash flow. This combination of income assurance and structured payments helps build financial discipline.

Operational credibility acts as a strengthener for the sale Fully leased commercial assets complement new launches in balancing the yield between proven performance and future growth. Well known retail and commercial destinations with a tenant roster that could be trusted have occupancy stability and execution reliability. By focusing on proven results, rather than projections, the sale reduces perceived risk to conservative investors.

Inventory diversity is budget appropriate. Entry level luxury shares space with global brand ultra premium homes in Gurgaon and Noida. Landmark partnerships and distinct architectural towers increase appeal. Smartworld residential projects expand mid to premium access. This layered inventory is capable of handling first time buyers, portfolio consolidators, and high net worth investors alike.

New projects included in the sale provide a forward-progressive push. Fresh launches allow buyers to get in with flexible payment plans. Coupled with out-the-box commercial areas and performing retail centers, the balanced offering adds to the ecosystem’s strength.

Marketing reinforcement is the basis of the goals of the sale. A wide-reach across the print, digital, outdoor, radio and broker networks increases visibility. Lifestyle incentives serve as a complement to financial incentives, which creates a sense of urgency while retaining the fundamental message of liquidity and exit guarantee. The message remains the same – secure premium assets through structured finance and clear exit paths.